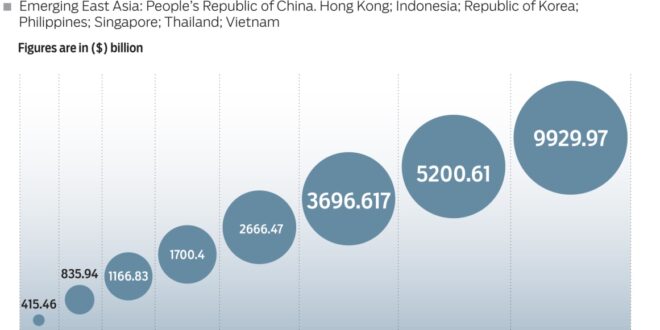

Trading volume in local currency Asian bonds has grown from less than an annual $500 billion in 2008 to more than $1 trillion in 2012, and a new report from Greenwich Associates and HSBC suggests strong growth will continue.

When local currency bonds emerged five years ago as a legitimate, albeit small, subset of fixed-income investing in Asia, their appeal was predicated on offering solid risk-adjusted yield at a time when any yield was difficult to find. The very notion that there even is a local currency bond market speaks volumes at the progress many Asian nations have made in embracing the structural adjustments needed to move from bank financing to a capital markets approach.

Greenwich Associates Asia (ex Japan) Fixed-Income studies, which annually survey around 1,000 institutional investors in the region, show that foreign holdings of Asian local currency bonds have grown from $150 billion in 2009 to well over $446 billion today. Trading volumes in local currency corporate bonds are growing at a higher rate than government bond volumes; in 2012, corporate bond volume increased by just over 20%, and now accounts for about one-third of the total local currency volume.

“That the investments in local currency bonds have continued to grow in both local and foreign investors’ portfolios is an indication of how Asia has managed to emerge from the post-2008 world in a way that portends well for its future,” says Amar Darira, head of credit sales for Asia-Pacific at HSBC. “A move towards global best practice in terms of protecting creditors’ rights, fostering a stable inflationary environment, and recognizing the need to replace unilateral financings that banks are no longer able to carry on their books have all contributed to the continuing popularity of the asset class.”

Analyzing the Markets The new report from Greenwich Associates and HSBC, entitled, Opportunities and Challenges in Asian Local Currency Fixed Income, examines the current environment for investing in local currency markets and the best practices that investors will want to consider. What is important to note is that just as Asia is a collection of countries all at different stages of economic development, the local currency bond markets in each country have their own unique rules and regulations. To help readers understand and navigate these markets, the report provides detailed breakdowns of the local currency bond markets in China, South Korea, India, Indonesia, Malaysia, Thailand, and Vietnam.

“On one hand, foreign investors are looking to capitalize on the growth prospects in Asia, while at the same time investors are wary about liquidity risk and their ability to anticipate local market developments,” says Abhi Shroff, consultant at Greenwich Associates in Singapore. “It becomes critical for investors to have strong on-the-ground presence in this region, or to work with firms that do.”

FuturesMag

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.

Asia Finance News Asia finance news, banking, market analysis, business, Forex, trade, Cryptocurrency as it is happening in Asia. Trusted gateway for Asian financial news.